When a rapidly growing biopharma company identified the perfect West Coast headquarters location, they encountered a problem that would have stopped most deals in their tracks: the 75,000-square-foot facility was a former electronics manufacturing site with significant environmental contamination. The traditional environmental consultant’s assessment recommended walking away from the property entirely.

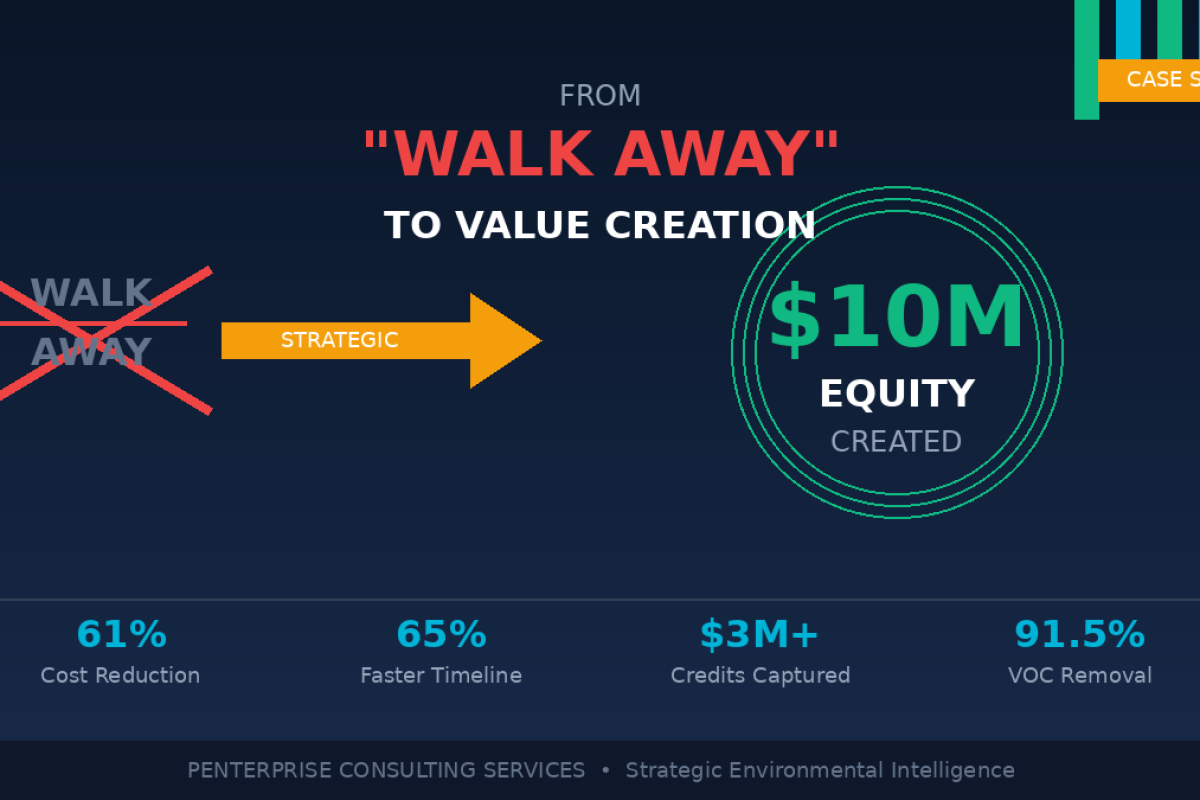

But walking away would have meant losing a strategic location with exceptional value potential. Instead of accepting the conventional wisdom, the company engaged PEnterprise Consulting Services for a strategic environmental intelligence review. What followed was an 18-month transformation that not only saved the deal but created $10 million in equity value.The Challenge: A “Walk-Away” Recommendation

The initial environmental assessment painted a daunting picture:

- Estimated remediation cost: $5 million

- Projected timeline: 36-48 months

- Recommendation: “Consider alternative sites”

For most companies, this would have been the end of the story. The conventional approach to environmental contamination focuses on minimizing liability and meeting minimum cleanup standards. But this approach often overlooks the strategic value hidden within seemingly problematic properties.

Our Strategic Approach: Optimizing Value, Not Just Managing Risk

When PEnterprise was engaged, we asked a fundamentally different question: “How do we optimize value?” instead of “What’s the minimum cleanup required?”

Our team conducted a comprehensive environmental intelligence analysis that went beyond traditional Phase I and Phase II assessments. We evaluated:

Long-term liability mitigation approachesThe 18-Month Transformation: Results That Exceeded Expectations

Through strategic environmental intelligence and value-optimized remediation planning, we achieved remarkable results:

Financial Impact

- Net remediation cost: $1.96 million (after environmental credits and incentives)

- 61% cost reduction compared to the original $5 million estimate

- Post-remediation property value: $18 million

- Net equity creation: $10 million+

Timeline Achievement

- 14 months to regulatory closure

- 65% faster than the originally projected 36-48 month timeline

- Enabled the client to occupy and begin operations years ahead of schedule

Environmental Performance

- 91.5% VOC removal achieved

- Full regulatory compliance and closure obtained

- Long-term environmental liability eliminated

The Key Differentiators: Why Our Approach Works

1. Strategic Site Characterization

We didn’t just identify contamination—we mapped contamination patterns to understand the most cost-effective remediation strategies specific to the client’s intended use.

2. Regulatory Pathway Optimization

By working closely with state regulators early in the process, we identified an accelerated pathway that met all regulatory requirements while dramatically reducing timeline and costs.

3. Financial Engineering

Our team identified over $3 million in environmental credits, grants, and incentives that the original consultant had overlooked, including:

Federal Environmental Response LiabilityAct (CERCLA) exemptions

- State Voluntary Cleanup Program incentives

4. Risk-Based Cleanup Strategy

Rather than pursuing expensive “pristine” cleanup standards, we implemented risk-based remediation appropriate for commercial biopharma use, achieving full regulatory compliance at a fraction of the cost.

5. Construction Integration

Our team coordinated remediation activities with the building renovation schedule, enabling parallel work streams that saved months from the overall project timeline.

Lessons for Healthcare and Biopharma Developers

This case study demonstrates several critical insights for healthcare and biopharma real estate developers:

1. Don’t accept “walk-away” recommendations at face value. Many environmental consultants are trained to minimize risk, not optimize value. A second opinion from strategically-minded environmental professionals can uncover hidden opportunities.

2. Environmental challenges can become competitive advantages. Properties with environmental issues often sell at significant discounts. Strategic remediation can create equity through the difference between purchase price and post-remediation value.

3. Timeline acceleration has immense value. In this case, reducing the timeline by 24+ months enabled the client to begin generating revenue years earlier, with a value far exceeding the remediation cost savings.

4. Regulatory relationships matter. Early, proactive engagement with regulatory agencies can identify accelerated pathways that aren’t obvious from standard guidance documents.

The Bottom Line

What started as a “walk-away” recommendation transformed into a $10 million equity creation opportunity. The difference wasn’t just technical expertise—it was asking the right question: “How do we optimize value?” instead of “What’s the minimum cleanup required?”Are You Walking Away from Value?

For healthcare and biopharma companies planning facility expansions or relocations, environmental challenges don’t have to be deal-breakers. With strategic environmental intelligence, they can become opportunities for value creation.

How many opportunities is your team walking away from because of conventional environmental consulting approaches?

Contact PEnterprise Consulting Services

If you’re evaluating healthcare or biopharma real estate opportunities with environmental considerations, our Environmental Intelligence Review (EIR) can help you:

- Identify hidden value in environmentally impacted properties

- Reduce remediation costs through strategic planning

- Accelerate project timelines

- Maximize available credits and incentives

- Transform environmental challenges into competitive advantages

Contact us today for a confidential consultation:

Email: information@penterprise.org

Phone: 877-531-1911

Visit our website at penterprise.org to learn more about our Environmental Intelligence services for healthcare and biopharma development projects.

About PEnterprise Consulting Services: We provide strategic environmental intelligence and consulting services to healthcare and biopharma companies navigating complex real estate development projects. Our value-optimization approach has helped clients unlock millions in equity value from properties that traditional consultants recommended walking away from.

California Brownfield Tax Incentives

Regulatory pathway options and their timeline implications

Available state and federal environmental credits and incentives

Risk-based cleanup alternatives appropriate for the intended use

Soil and groundwater management strategies